federal unemployment tax refund reddit

They also told me I wasnt alone many people still hadnt received their unemployment refund. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Situations covered in TurboTax Free Edition includes.

. Immediately contact the unemployment office so they dont hold you responsible for the fraud. If the 1099-G is for unemployment benefits this may be a case of identity theft. A simple tax return is Form 1040 only OR Form 1040 Unemployment Income.

Use Form 940 or 940-EZ Employers Annual Federal Unemployment FUTA Tax Return to report this tax. Unemployment federal tax refunds. 24 and runs through April 18.

Department of Labors Contacts for State UI Tax Information and Assistance. The IRS said over two weeks ago that they would begin depositing these refunds the week of the 14th beginning with phase 1 single simple returns and moving onto MFJ returns. Heres what to know about paying taxes on unemployment benefits in tax year 2021 the return youll file in 2022.

If you received a 1099-G and never filed for unemployment first double check the amount on the 1099-G wasnt your state tax refund. In the latest batch of refunds announced in November however the average was 1189. Im not holding my breath on this rollout.

You can get this form by calling 800-829-3676. You did not get the unemployment exclusion on the 2020 tax return that you filed. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax.

IR-2021-212 November 1 2021. I was only on it for a few weeks but its my understanding that we will be refunded the federal tax thanks to the ARPA. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. W-2 income limited interest and dividend income reported on a 1099-INT or 1099-DIV claiming the standard deduction Earned Income Tax Credit EIC child tax credits unemployment income reported on a 1099-G. If you employ one or more part-time or full-time employees you must have Worker Compensation Insurance before your employees start work.

On September 22 TurboTax advised me to go ahead and file an amended return. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. For more information refer to the Instructions for Form 940.

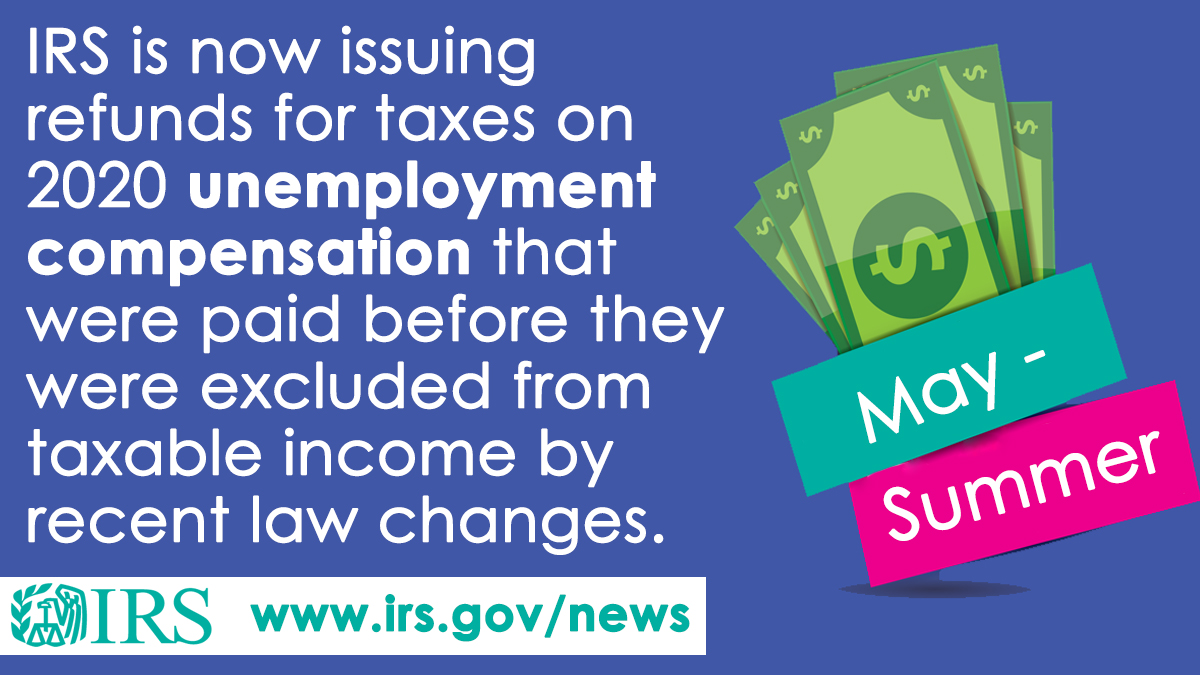

State tax refunds also go on 1099-G. The federal tax code counts jobless benefits. The IRS will begin in May to send tax refunds in two waves to those who benefited from the 10200 unemployment tax break for claims in 2020.

It is not deducted from the employees wages. IR-2021-159 July 28 2021. If the refund is offset to pay unpaid debts a notice will be sent to inform you of the offset.

COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. Originally started by John Dundon an Enrolled Agent who represents people against the IRS rIRS has grown into an excellent portal for quality information from any number of tax professionals and Reddit contributing members. Use Form 940 or 940-EZ Employers Annual Federal Unemployment FUTA Tax Return to report this tax.

WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. Tax season started Jan. The IRS efforts to correct unemployment compensation overpayments will help most of the affected.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. Raise your hand if you still havent received your federal unemployment tax refund. My CTC was put on hold because of the amended tax return I.

Only the employer pays FUTA tax. The IRS has sent 87 million unemployment compensation refunds so far. Waiting for your unemployment tax refund about 436000 returns are stuck in the irs system.

Best just to forget about it and let it be a happy surprise when or if it shows up. Most employers pay both a Federal and a state unemployment tax. Do not click anything else.

This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Has anyone received their federal tax refund from unemployment. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. Unpaid debts include past-due federal tax state income tax state unemployment compensation debts child support spousal support or certain federal nontax debts such as student loans. If by chance you filed with turbo tax you can go to your main page click see all returns it may not be that exact wording but its close then click add state.

The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. So I filed my amended state MI and federal returns. Click those lines and you can then view what the new refund amount is.

You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Im far too cynical now waiting on my tax refund.

I received my state amended refund around a month later. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. Most employers pay both a Federal and a state unemployment tax.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. For a list of state unemployment tax agencies visit the US. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7.

On the page to add a new state you will see 3 lines in the upper left corner. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Will Tax Refunds Be Lower This Year For Americans As Com

The Irs Can Seize Your Unemployment Tax Refund For These Reasons

Irs Announces It Will Automatically Correct Tax Returns For Unemployment Tax Breaks

Unemployment Tax Break 2022 Federal Income Tax Zrivo

What Is Form 940 When Do I Need To File A Futa Tax Return Ask Gusto

Unemployment Tax Refund Advice Needed R Irs

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Questions About The Unemployment Tax Refund R Irs

Still Waiting For Your 10 200 Unemployment Tax Refund How To Check Status Dailynationtoday

It S Here Unemployment Federal Tax Refund R Irs

Can Someone Explain This Tweet From The Irs Like I M A Dummie R Tax

Irsnews On Twitter Irs Is Correcting Tax Returns For Unemployment Compensation Income Exclusion The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns This Could Result In Refunds For

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Just Got My Unemployment Tax Refund R Irs

Unemployment Tax Refund Irs Zrivo

Unemployment Tax Overpayment Expecting Refund But Nothing Yet R Irs